Florida - Thursday January 5, 2023: The COVID-19 pandemic and resulting economic crisis caused unprecedented financial strain throughout the U.S., prompting the federal government to offer economic relief packages at every level, from stimulus checks for personal use to local fiscal recovery funds at the state level. But the Paycheck Protection Program (PPP) is one of the most memorable.

A new study by Smartest Dollar looked at which U.S. locations received the most Paycheck Protection Program (PPP) funds.

It found that Florida ranked 31st in per capita acceptance of PPP funding, with a median PPP loan amount of $19, 035.

Florida businesses took in $2,298 in PPP funds per capita, for a total of $50.1 billion in PPP funds, 92.0% of which was forgiven.

The top 10 states receiving PPP funds per capita were North Dakota, New York, South Dakota, Massachusetts, Illinois, Minnesota, Wyoming, Alaska, New Jersey, and Connecticut.

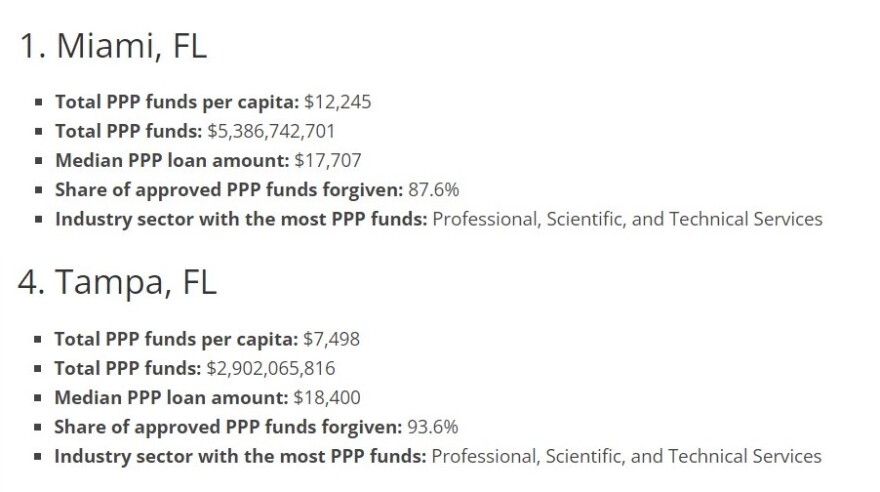

However amongst the large cities nationwide that took the most PPP money per capita, Miami Florida was first, and Tampa was fourth.

In the small to mid-size city category West Palm Beach ranked first in the amount of PPP funding that it took in per capita nationwide.

Here is a summary of the data for Florida:

• Total PPP funds per capita: $2,298

• Total PPP funds: $50,058,979,878

• Median PPP loan amount: $19,035

• Share of approved PPP funds forgiven: 92.0%

• Industry sector with the most PPP funds: Professional, Scientific, and Technical Services

Click on this link to find a summary of the analysis with data for Florida as well as a review of the PPP data on more than 300 cities and all 50 states: https://smartestdollar.com/research/cities-that-took-the-most-ppp-money

Here are the statistics for the entire United States:

• Total PPP funds per capita: $2,388

• Total PPP funds: $792,611,806,528

• Median PPP loan amount: $20,689

• Share of approved PPP funds forgiven: 95.2%

• Industry sector with the most PPP funds: Construction

The data used in this analysis is from the U.S. Small Business Administration’s Office of Capital Access. To determine the locations that received the most Paycheck Protection Program (PPP) funds, researchers at Smartest Dollar calculated the total PPP funds per capita. In the event of a tie, the location that received the greater total PPP funds was ranked higher.

Funds that were distributed through the PPP also varied by state as a result of differences in COVID-19 impacts, politics, small business densities, and other local economic factors. Generally, states in the northern half of the U.S.—such as the Dakotas, New York, Massachusetts, and Illinois—received more PPP funds per capita than states in the southern half of the country.

North Dakota received the most PPP funds per capita at $3,734. New York and South Dakota received the second and third most PPP funds per capita at $3,062 and $3,048, respectively.

At the opposite end of the spectrum, West Virginia ($1,458), New Mexico ($1,598), and Arkansas ($1,651) received the lowest amount of PPP funding per person.

The PPP Program

To help businesses stay afloat, the government-led initiative allowed companies with fewer than 500 employees to apply for forgivable loans. With mandated store closures, social distancing guidelines, and increased cleaning requirements, many businesses were faced with a series of hard choices, like laying off certain employees to meet payroll for others, or closing their doors forever to avoid a very uncertain future. PPP loans were intended to help businesses keep their doors open with less stress, retain employees, and boost suffering local economies.

During its first of three rounds from April 3, 2020 to August 8, 2020, the PPP distributed $525 billion to small businesses in need, and eventually distributed nearly $800 billion in loans by the time the program ended in mid-2021. While economists for the U.S. Department of the Treasury applaud the program for saving nearly 19 million jobs by December of 2020, others argue the real number is much less, and closer to between 1.4 and 3.2 million.

Recipients of PPP loans were initially required to spend 60% of allocated funds on payrolls in order for them to be eligible for loan forgiveness, as the funds were intended for businesses to pay their workers, avoid layoffs, and stay in business. For many small businesses—especially those with fewer than 10 employees—it makes sense that a small loan could accomplish these goals, and over two-thirds of PPP loans, or 66%, were approved for less than $25,000. However, since companies with up to 500 employees were eligible for PPP funding, many small businesses were approved for much larger amounts. While just 2% of PPP loans were approved for between $100,000 and $124,999, 10% were approved for over $125,000. The remainder of loans fell between $25,000 and $99,999: 11% were between $25,000 and $49,999, 5% were between $50,000 to $74,999, and 3% were between $75,000 and $99,999.

Businesses from every industry were able to apply for a PPP loan, but some fields were approved for more funds than others. Construction businesses with fewer than 500 employees secured the most money overall, receiving nearly $98 billion in PPP loans. The healthcare and social assistance industry and professional, scientific, and technical industry were not far behind, receiving roughly $96 billion and $94 billion, respectively. Accommodation and food services received the fourth largest amount in PPP loans overall, and first relative to its smaller GDP.

It’s no surprise that construction tops the list: As existing projects were put on hold, new business slowed, and disruptions and shortages impacted supply chains, construction was one of the hardest hit industries of the pandemic. The same was true for small businesses in the accommodation and food services sector, which had to navigate a combination of plummeting demand, staffing shortages, and supply chain disruptions, among other issues.

For more information, a detailed methodology, and complete results, you can find the original report on Smartest Dollar’s website: https://smartestdollar.com/research/cities-that-took-the-most-ppp-money