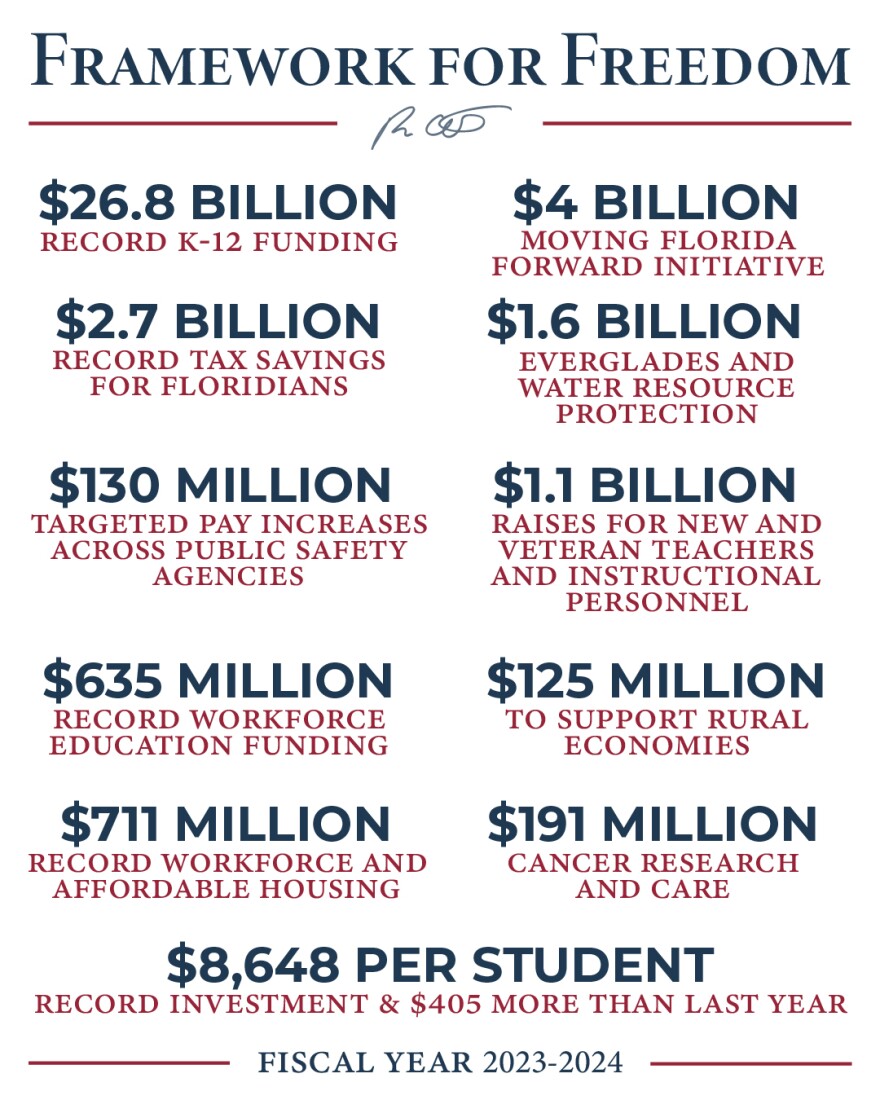

Florida - Thursday June 15, 2023: While visiting the City of Fort Pierce Thursday Governor DeSantis signed into law what he is calling the Framework for Freedom Budget for Fiscal Year 2023–24. The budget totals $116.5 billion. It takes effect at the start of the fiscal year on July 1.

It includes a record $2.7 billion tax relief package. Additionally, the Governor highlighted record investments in Florida’s environment and natural resources which are a cornerstone of Florida’s economy, including a record $1.6 billion investment in Everglades restoration and water quality projects.

The budget also includes a Debt Reduction Program that will immediately reduce Florida’s debt by approximately $400 million, saving an estimated $31 million and accelerating debt reduction.

Florida maintains healthy reserves at the end of the fiscal year, totaling more than $15.3 billion. The state also has record levels of reserves.

Statewide Overview and Taxes

The Framework for Freedom Budget for Fiscal Year 2023-24 totals $116.5 billion and continues Governor DeSantis’ commitment to Florida’s K-12 students, parents and teachers, environmental resources, and law enforcement, all while maintaining healthy reserves, including $6.8 billion in General Revenue.

Of the total $116.5 billion, the General Revenue portion is $46.1 billion. Florida’s total reserves are $15.3 billion, 13.2 percent of the total budget for the fiscal year, leaving ample resources for any unforeseen circumstances.

Taxpayer Savings

The Framework for Freedom Budget provides $2.7 billion in record tax relief for Florida families, including permanent tax cuts to keep more money in the pockets of Floridians. Florida’s per capita state tax collections of $2,264 is the third lowest among all states. The Framework for Freedom Budget includes the following permanent and temporary tax cuts:

• $500 million in toll relief to frequent commuters which began on January 1, 2023 – This discounts tolls by 50 percent in 2023 for frequent drivers utilizing SunPass with more than 35 monthly transactions.

• A permanent sales tax exemption for baby and toddler necessities for $158.7 million – This covers certain baby and toddler necessities such as clothing, shoes, and diapers for children under 5, all baby wipes and cribs and strollers.

• A permanent sales tax exemption for diapers and incontinence products for $27.5 million – The budget exempts adult diapers and incontinence undergarments, pads and liners.

• A permanent sales tax exemption for oral hygiene products for approximately $39.8 million – The exemption covers toothpaste, mouthwash, dental floss, electric and manual toothbrushes and dental picks and irrigators.

• A 1-year sales tax exemption on gas stoves for $6.9 million – Gas stoves are free from federal overreach in Florida. The Framework for Freedom Budget exempts from sales tax the purchase of new stoves that are fueled by combustible gas such as syngas, natural gas, propane, butane, liquefied petroleum gas or other flammable gas.

Protecting Florida's Natural Resources

The budget dedicates more than $1.6 billion for the protection of water resources, the first installment of $3.5 billion in spending over the next four years for Everglades restoration and protection of water resources, including water quality and water supply.

$694 million for Everglades restoration projects, including:

• $356.5 million for the Comprehensive Everglades Restoration Plan (CERP).

• $64 million for the EAA Reservoir to continue the momentum of this critical project to reduce harmful discharges and help send more clean water south of the Everglades.

• $50 million is included for specific project components designed to achieve the greatest reductions in harmful discharges to the Caloosahatchee and St. Lucie Estuaries as identified in the Comprehensive Everglades Restoration Plan Lake Okeechobee Watershed Restoration Project Draft Integrated Project Implementation Report and Environmental Impact Statement dated August 2020.

• $96.1 million is included for the Northern Everglades and Estuaries Protection Program.

The budget also includes $796 million for targeted water quality improvements to achieve significant, meaningful, and measurable nutrient reductions in key waterbodies across the state and to implement the initial recommendations of the Blue-Green Algae Task Force.

On top of the investment in targeted water quality improvements, the budget includes $50 million to restore Florida’s world-renowned springs; $85 million for the continued stabilization, water treatment, and closure at Piney Point; and a $59 million investment to improve water quality and combat the effects and impacts of harmful algal blooms, including blue-green algae and red tide.

$17 million will support the ongoing oyster restoration operation in Apalachicola Bay. This investment will double the supported acreage from 1,000 to 2,000 acres of durable oyster habitat.

There is also an appropriation of more than $2.8 billion for Florida’s agricultural industry, including $52.4 million for citrus research, a Citrus Health Response Program, and consumer awareness marketing efforts to preserve Florida’s iconic citrus industry.

Additionally, the budget funds $1 billion to protect our prized properties and waterways, including $850 million for lands within the Florida Wildlife Corridor and $100 million for the Florida Forever Program to support land conservation and recreation.

Education

• $1.1 billion, an increase of $252 million, in funding to provide salary increases for new and veteran teachers and other eligible instructional personnel.

• $1.6 billion in funding for early childhood education, including more than $427 million for Voluntary Pre-Kindergarten (VPK).

• Historic $26.8 billion in funding for the K-12 public school system.

• $1.7 billion in state operating funding for the Florida College System.

• $3.7 billion in state operating funding for the State University System.

• $100 million for the recruitment and retention of highly qualified faculty at state universities.

• $25 million for the institutional overhaul and restructuring of the New College of Florida.

The budget $26.8 billion in total funding for the Florida Education Finance Program (FEFP), that includes the highest per student investment of $8,648, which is an increase of $405 over Fiscal Year 2022-23.

There are no tuition or fee increases for Florida’s colleges and universities.

Work Force Education

The budget includes $635 million to support workforce education programs to ensure Florida students are prepared to fill high-demand, high-wage jobs, and help Florida meet its goal of becoming first in the nation for workforce education by 2030.

This includes $20 million, an increase of $5 million, to develop the Teacher Registered Apprenticeship Program for the Governor’s Pathways to Career Opportunities Grant Program to establish or expand pre-apprenticeship and apprenticeship programs for high school and college students.

The budget maintains $125 million in total funding to support the LINE and PIPELINE nursing education initiatives.

Economic Development

The budget includes $14.8 billion for the Florida Department of Transportation to retain current employees and supports the creation of more than 254,000 jobs. Of this total, $13.9 billion is provided for the State Transportation Work Program, an ongoing five-year plan for the implementation and completion of transportation infrastructure projects, including the construction and maintenance of Florida’s roads, bridges, rails, seaports, and other public transportation systems that grow the state’s economy and improve the quality of life for our citizens.

The budget invests $4 billion in a new initiative to address the challenge of congestion on Florida’s highways and roads.

Additionally, $75 million will support the Florida Job Growth Grant Fund, which helps fund projects that support public infrastructure and expand workforce education opportunities.

To further support Florida’s rural communities, the budget includes $25 million for the Rural Infrastructure Fund to help rural communities expand necessary infrastructure. Additionally, the budget includes $100 million to help small and rural communities expand access to broadband Internet.

Public Safety

$130 million in the budget to provide salary increases across various public safety agencies, including $60.5 million to increase the Department of Corrections’ (FDC) base rate of pay to $22 per hour for specified Correctional Officer and Correctional Probation Officer positions.

$110 million for payments to local government first responders through the First Responder Recognition Payments Program. Additionally, $20 million will fund a second round of recruitment bonus payments for law enforcement officers who are new to the profession in the state, including those relocating from other states. This initiative will provide bonus payments of $5,000 to eligible law enforcement officers.

$20.7 million to support law enforcement efforts to combat the opioid epidemic affecting Florida’s communities, including the creation of the State Assistance for Fentanyl Eradication (S.A.F.E.) in Florida Program.

Emergency Management and Hurricane Recovery

$2.3 billion for mitigation, response and recovery efforts through the Florida Division of Emergency Management.

$750 million in disaster relief funding during the December 2022 Legislative Special Session. $350 million of this funding was to provide the full match requirement for FEMA Public Assistance grants to local governments affected by Hurricanes Ian and Nicole.

Additionally, Florida is setting aside $500 million for the Emergency Preparedness and Response Fund.

Military and Veteran Support

Record funding of $102.5 million to launch a multi-year initiative at Camp Blanding for the construction of multiple state-of-the-art training facilities for the Florida National Guard. This major investment in live-fire ranges, infantry battle courses and barracks to support simultaneous training of 5,000 guardsmen, will elevate Florida’s force readiness and reduce our dependence on federal and other state resources.

$5.2 million to support Florida National guardsmen seeking higher education degrees and $3 million to give $1,000 bonuses to guardsmen who recruit new members into the Florida National Guard.

Provides $108 million to grow the Florida State Guard, a civilian volunteer force, to aid during emergencies.

The budget invests an additional $6 million for medical and non-medical equipment upgrades, capital improvements, and increased staffing for the State Veterans’ Nursing Homes. The budget also includes funds to begin planning for the construction of the ninth State Veterans’ Nursing Home in Collier County.

The budget also continues a $2 million investment to assist veterans in securing meaningful skills-based employment, provide employers a skilled talent pipeline and to assist veterans in creating and operating a small business.

Public Health

More than $190 million in cancer research funding, with $20 million in funding to establish the Florida Cancer Innovation Fund to support groundbreaking cancer research.

$290 million to enhance services for new and expecting mothers and their children. This funding also includes $3.8 million to support premiums for families who receive services through the Florida KidCare Program and were impacted by Hurricane Ian.

An additional $30 million was included for Fiscal Year 2023-24 in the Heartbeat Protection Act to support life and family in the State of Florida. Additional resources available for mothers and families will include parenting support services, nonmedical materials like cribs, car seats, clothing, diapers and formula, counseling and mentoring, education materials, and classes on pregnancy, parenting, adoption, life skills and employment readiness.

More than $100 million to support those served by the child welfare system. Funding will support foster parents and caregivers, community-based services, local prevention grants, and additional family navigators to connect high risk families and children to resources and supports through collaboration with front line child protective investigators.

An additional $76 million for hospitals that care for acutely ill newborns and pediatric patients.

More than $625 million in funding to support a comprehensive array of behavioral health services. More than $385 million is included in the budget to support prevention and treatment services to respond to the opioid epidemic. This funding will increase access to medication assisted treatment, recovery support and will continue research and surveillance activities that seek to reduce overdoses, unemployment, and the incidence of hospitalization and homelessness. Of this funding, $187 million is supported by proceeds from the Opioid Settlement Agreement.

• $1.5 million to provide services for victims of human trafficking, including individualized clinical treatment and behavioral supports.

• An additional $9 million to expand services provided by the 17 Memory Disorder Clinics and the Brain Bus to enhance diagnosis and prevention strategies for those impacted by Alzheimer’s disease and other related dementias.

• $79.6 million in funding is provided to the Agency for Persons with Disabilities to serve additional individuals with disabilities.